views

The Generative AI Boom in Banking: What It Means for the Future of Finance

A New Era in Banking Begins

AI is no longer just assisting banks—it’s leading innovation.

The Generative AI in banking market is transforming the industry at its core. With the ability to generate human-like responses, streamline workflows, and predict financial trends, generative AI is no longer experimental—it’s essential. From back-office operations to customer-facing tools, banks are turning to this technology to stay competitive in an increasingly digital world.

Innovation That Drives Results

Banks are using AI to go beyond traditional service models.

Whether it’s drafting personalized investment strategies, automating compliance tasks, or generating insights from massive data sets, generative AI is unlocking new ways for banks to serve clients faster and smarter. These AI systems are enabling real-time decision-making, improving risk management, and making the customer experience feel more human than ever.

The Numbers Behind the Growth

The market is expanding fast—and it’s only just begun.

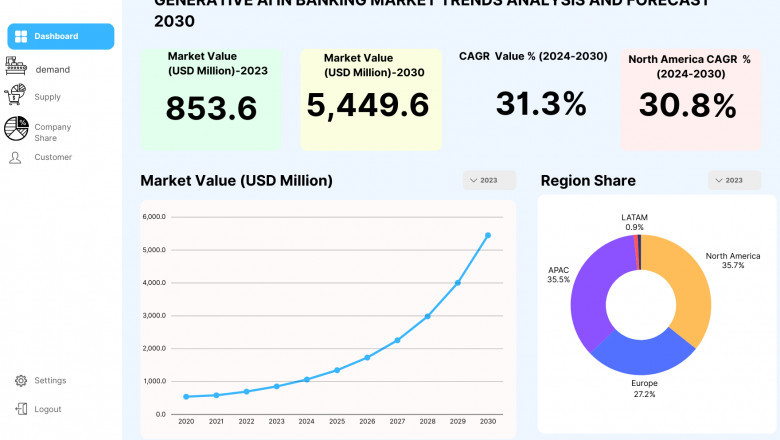

The Generative AI in Banking Market Size tells a compelling story of rapid adoption. In 2023, the market was valued at USD 853.6 million. It is projected to skyrocket to USD 5,449.6 million by 2030, growing at a compound annual growth rate (CAGR) of 31.3% from 2024 to 2030. These figures reflect a massive shift in how banks view and invest in AI capabilities.

What’s Fueling the Growth Surge?

AI offers solutions to modern banking’s biggest challenges.

The increasing complexity of financial services, pressure to reduce operational costs, and demand for hyper-personalized digital experiences are driving the sharp rise in the Generative AI in Banking Market Size. Banks are recognizing that generative AI isn’t just a nice-to-have—it’s a strategic asset that boosts efficiency, accuracy, and customer loyalty.

Looking Forward: AI as the Financial Brain

Generative AI will be at the heart of banking innovation.

In the coming years, generative AI will evolve from a support tool to the core intelligence behind many banking operations. From virtual advisors to AI-powered product development, the technology will shape how financial institutions think, respond, and grow. The future of banking belongs to those who embrace this transformation now.

Contact Information:

Company Name: Mark & Spark Solutions

Contact Person: Sushil W

Email: sales@marksparksolutions.com

Phone: +1-585-374-1088

Website: https://marksparksolutions.com

Comments

0 comment