views

IMARC Group, a leading market research company, has recently released a report titled “Trade Finance Market Report by Finance Type (Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance), Offering (Letters of Credit, Bill of Lading, Export Factoring, Insurance, and Others), Service Provider (Banks, Trade Finance Houses), End-User (Small and Medium Sized Enterprises (SMEs), Large Enterprises), and Region 2025-2033”. The study provides a detailed analysis of the industry, including the global trade finance market share, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

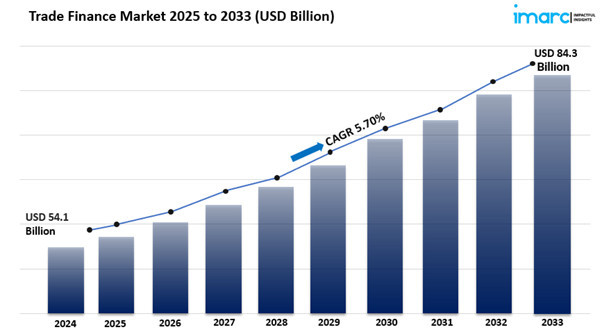

The global trade finance market size reached USD 54.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 84.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033.

https://www.imarcgroup.com/trade-finance-market/requestsample

The Future of the Trade Finance Market

The trade finance market is poised for significant evolution as various trends converge to shape its future. By 2025, the demand for trade finance solutions will be closely linked to the ongoing digital transformation and the integration of advanced technologies that enhance operational efficiency. As global trade continues to expand, particularly in emerging markets, the need for accessible and tailored trade finance products will surge.

Additionally, the evolving regulatory landscape will necessitate robust compliance measures, pushing financial institutions to innovate and streamline their processes. Overall, the trade finance market is set to become more dynamic and responsive, characterized by technological advancements, a focus on emerging markets, and a commitment to meeting regulatory requirements, ultimately redefining how businesses engage in international trade.

Market Dynamics of the Trade Finance Market

Digital Transformation and Technological Integration

The trade finance market is undergoing a significant transformation driven by the rapid adoption of digital technologies. As businesses increasingly seek efficiency and transparency in their financial operations, the demand for digital trade finance solutions is surging. Technologies such as blockchain, artificial intelligence (AI), and machine learning are being integrated into trade finance processes to streamline operations, reduce fraud, and enhance compliance.

By 2025, it is expected that these technologies will play a crucial role in automating various aspects of trade finance, including risk assessment, document verification, and payment processing. Blockchain, in particular, is poised to revolutionize the market by providing a secure and immutable ledger for transactions, thereby increasing trust among trading partners. As financial institutions and corporations embrace these innovations, the trade finance market will become more agile, allowing companies to respond quickly to changing market conditions and customer demands.

Growing Global Trade and Emerging Markets

The trade finance market is significantly influenced by the growth of global trade, particularly in emerging markets. As economies in Asia, Africa, and Latin America continue to expand, the demand for trade finance solutions is expected to rise. By 2025, these regions will likely become key players in international trade, driven by factors such as population growth, urbanization, and increasing consumer demand. This shift presents both opportunities and challenges for trade finance providers, as they must adapt to the unique needs of businesses operating in diverse regulatory environments.

Additionally, the rise of small and medium-sized enterprises (SMEs) in these markets will create a greater need for accessible trade finance solutions, as these businesses often face difficulties in obtaining credit. Financial institutions will need to develop tailored products and services that cater to the specific requirements of SMEs, fostering growth and facilitating international trade in emerging markets.

Regulatory Changes and Compliance Challenges

The trade finance market is also shaped by evolving regulatory landscapes and compliance challenges. As governments and regulatory bodies implement stricter regulations to combat money laundering, fraud, and financing of terrorism, trade finance providers must navigate a complex web of compliance requirements. By 2025, it is anticipated that regulatory frameworks will continue to evolve, necessitating enhanced due diligence and reporting practices for financial institutions engaged in trade finance. This increasing regulatory burden can pose challenges for banks and other financial service providers, particularly smaller institutions that may lack the resources to implement comprehensive compliance programs.

However, it also presents an opportunity for innovation, as firms that successfully integrate compliance measures with their trade finance solutions can differentiate themselves in a competitive market. As a result, the trade finance landscape will be characterized by a heightened focus on compliance, driving investment in technology and processes that ensure adherence to regulatory requirements.

Trade Finance Market Report Segmentation:

Breakup by Finance Type:

· Structured Trade Finance

· Supply Chain Finance

· Traditional Trade Finance

The report presents a detailed segmentation and analysis of the market based on finance type, covering structured trade finance, supply chain finance, and traditional trade finance.

Breakup by Offering:

· Letters of Credit

· Bill of Lading

· Export Factoring

· Insurance

· Others

The report also provides a detailed segmentation and analysis of the market based on the offering, including letters of credit, bill of lading, export factoring, insurance, and others.

Breakup by Service Provider:

· Banks

· Trade Finance Houses

The report offers a detailed segmentation and analysis of the market based on service providers, including banks and trade finance houses. According to the findings, banks emerged as the largest segment.

Breakup by End-User:

· Small and Medium Sized Enterprises (SMEs)

· Large Enterprises

The report offers a detailed segmentation and analysis of the market based on end users, categorizing them into small and medium-sized enterprises (SMEs) and large enterprises.

Breakup by Region:

· North America

· Asia-Pacific

· Europe

· Latin America

· Middle East and Africa

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

Competitive Landscape with Key Players:

The competitive landscape of the trade finance market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

· Asian Development Bank

· Banco Santander SA

· Bank of America Corp.

· BNP Paribas SA

· Citigroup Inc.

· Crédit Agricole Group

· Euler Hermes

· Goldman Sachs Group Inc.

· HSBC Holdings Plc

· JPMorgan Chase & Co.

· Mitsubishi Ufj Financial Group Inc.

· Morgan Stanley

· Royal Bank of Scotland

· Standard Chartered Bank

· Wells Fargo & Co.

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=2031&flag=C

Key Highlights of the Report:

· Market Performance (2019-2024)

· Market Outlook (2025-2033)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Americas: +1-631-791-1145

Comments

0 comment