views

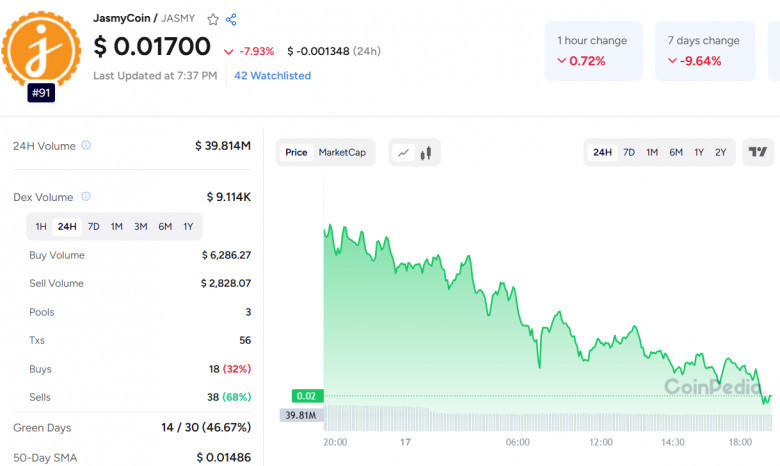

JasmyCoin (JASMY) is currently trading at $0.01700, showing a 24-hour volume of $39.7 million. Over the past hour, the token has declined by 0.72%, and since yesterday, it's down by 7.93%. Despite this dip, key indicators and expert commentary suggest that JASMY may still be on track for a potential bullish reversal, making the current outlook an interesting case for Jasmy price prediction.

Key Technical Insights

JASMY has a circulating supply of 49.4 billion tokens, with a maximum supply capped at 50 billion. Its 50-day Simple Moving Average (SMA) sits at $0.01486, indicating short-term bullish strength. However, the 200-day SMA is at $0.02323, signaling that the broader trend is still catching up.

According to chart patterns, the token is in a consolidation phase, but a breakout might be around the corner.

Bullish Scenario: Wave 5 Formation

If JasmyCoin maintains its upward trend line, the price could rally toward $0.05, completing Wave 5 of the Elliott Wave cycle. The key level to watch here is a break above the Wave 3 high of $0.048. A confirmed breakout would indicate renewed bullish momentum.

Also Read: EGLD Price Prediction 2025

Bearish Possibility: Support Test

In a bearish turn, if JASMY falls below its current trend line and support at $0.025, the token may decline further to test the invalidation level at $0.021.

-

A dip below $0.021 could trigger a longer bearish trend.

-

Staying above $0.025 keeps the bullish structure intact.

Expert Commentary

Matthew Dixon, CEO of Evai, cautioned traders not to expect a drop to the invalidation level. He stated:

“I DO NOT expect the price to go that low – just a possibility.”

For now, traders should watch key levels closely as JASMY hovers between a potential breakout and a deeper correction.

Comments

0 comment