views

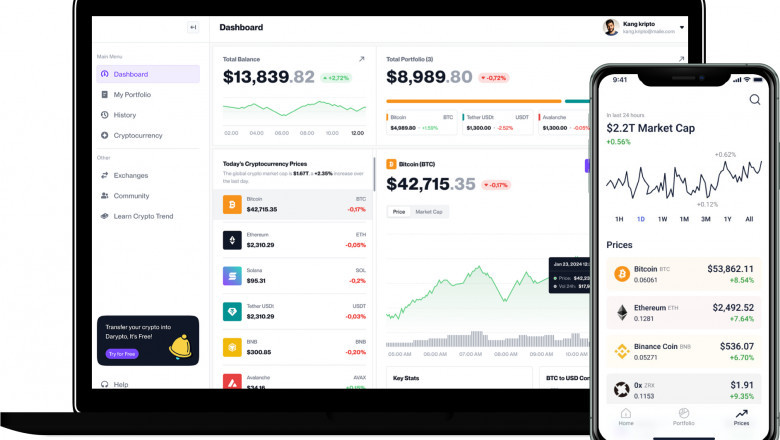

In the world of cryptocurrency trading, investors have different options to buy and sell digital assets. Two common methods are OTC crypto exchanges and traditional crypto exchanges. But what do they mean, and how do they differ? Let’s break it down in a simple way.

What is an OTC Crypto Exchange?

An OTC crypto exchange is a platform where buyers and sellers trade digital currencies directly with each other, without the need for an order book. These transactions are typically handled by brokers or specialized OTC desks. This method is preferred by institutions and high-net-worth individuals who need to trade large amounts of cryptocurrency without affecting market prices.

What is a Traditional Crypto Exchange?

A traditional crypto exchange, such as Binance or Coinbase, operates on an open market model where users can place buy and sell orders. These exchanges use an order book system to match buyers and sellers based on their bid (buy) and ask (sell) prices. The price of cryptocurrencies on traditional exchanges fluctuates based on real-time market supply and demand.

Key Differences Between OTC and Traditional Crypto Exchanges

| Feature | OTC Crypto Exchange | Traditional Crypto Exchange |

|---|---|---|

| Trading Method | Direct peer-to-peer or broker-facilitated trades | Uses an order book with market-driven prices |

| Market Impact | Minimal impact on market prices | Large trades can cause price fluctuations |

| Liquidity | High for large trades | Depends on exchange volume |

| Privacy | More private, as trades are not publicly recorded | Trades are visible on the exchange order book |

| Speed | Faster for big transactions | Can be slower, especially for large orders |

| User Base | Mostly institutions and high-net-worth traders | Open to all traders, including retail investors |

Which One Should You Choose?

-

OTC exchanges are ideal for those looking to trade large amounts of crypto privately and quickly without impacting market prices.

-

Traditional exchanges are best for everyday traders who want to buy and sell at market-driven prices with lower minimum trade sizes.

Power your crypto trading with a secure and efficient OTC exchange. Choose Debut Infotech for top-tier OTC crypto exchange development!

Both types of exchanges serve different needs, and choosing the right one depends on your trading goals. If you’re looking for a hassle-free way to trade large volumes, an OTC crypto exchange may be the right fit for you!

Comments

0 comment