views

South Korea Bovine Serum Albumin Market will grow at highest pace owing to biopharma research expansion

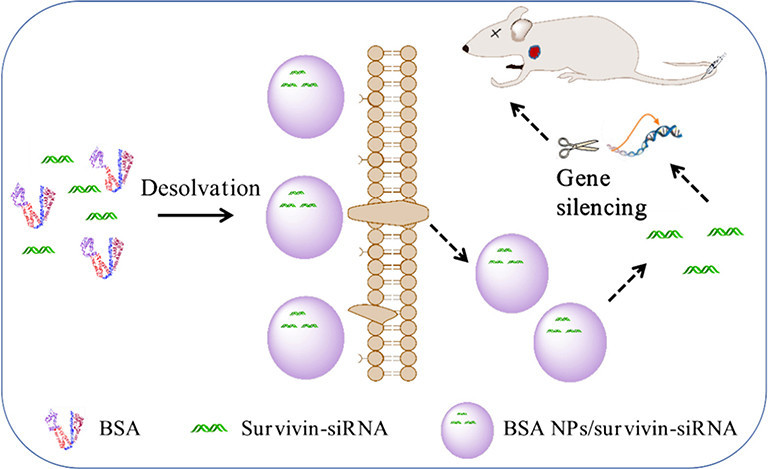

Bovine Serum Albumin (BSA) is a high-purity protein derived from bovine blood that serves as a stabilizer, blocker, and nutrient source in various life science applications. In South Korea, BSA is extensively used in cell culture media, immunoassays, drug formulation and delivery, and vaccine development. Its advantages include excellent buffering capacity, low endotoxin levels, and reliable performance in diagnostic kits and proteomics research. As the biopharmaceutical sector in South Korea continues to expand, demand for consistent, GMP-grade BSA is rising, supporting both small-scale research and large-scale manufacturing.

The need for South Korea Bovine Serum Albumin Market in areas such as monoclonal antibody production, enzyme assays, and point-of-care testing has prompted market players to invest in advanced purification and quality control processes. With growing investments in biotechnology infrastructure and increased focus on personalized medicine, the market’s scope is widening to include recombinant alternatives and innovative formulations.

The South Korea bovine serum Albumin market size is expected to reach US$ 7.9 Mn by 2032, from US$ 6.2 Mn in 2025, growing at a CAGR of 3.6% during the forecast period 2025-2032.

Key Takeaways

Key players operating in the South Korea Bovine Serum Albumin Market are:

-Proliant

-Kraeber & Co. GmbH

-Lake

-Immunogenics

-Gemini

Rising demand in cell culture and diagnostic segments is a primary driver of market growth. As South Korean research institutes and biopharma companies scale up monoclonal antibody production, the requirement for high-quality BSA has surged. Additionally, government initiatives supporting vaccine research and development have led to increased procurement of BSA for antigen formulation and stability testing. This growing demand is bolstering market revenue and encouraging players to focus on expanding their product portfolios. Moreover, academic and contract research organizations are seeking consistent supply of BSA for proteomics studies, reinforcing the protein’s status as an indispensable reagent in laboratory settings.

Technological advancement in BSA production and purification is reshaping the market dynamics. Market players are investing in chromatography-based techniques and ultrafiltration methods to achieve ultra-high purity and low endotoxin levels. The introduction of recombinant BSA produced through yeast and plant expression systems offers a non-animal-derived alternative, addressing market restraints related to supply stability and ethical concerns. Automation in downstream processing and stringent quality control protocols are further enhancing the overall market scope, driving innovation and bolstering market competitiveness.

Market Trends

One key trend is the shift toward recombinant BSA derived from non-animal sources. This development addresses both supply chain challenges and biosafety concerns associated with traditional bovine-derived products. Recombinant BSA ensures batch-to-batch consistency, minimal risk of pathogen transmission, and aligns with stringent regulatory norms in biopharmaceutical manufacturing. Companies are enhancing their market research efforts to validate recombinant alternatives in established protocols, paving the way for wider adoption.

A second trend is the integration of BSA into point-of-care diagnostic platforms. South Korea’s robust diagnostics industry is leveraging BSA as a blocking agent in lateral flow assays and ELISA kits to improve sensitivity and reduce nonspecific binding. As rapid diagnostic tests become more prevalent, demand for high-grade BSA tailored for these applications is increasing. This trend is expected to boost market share for suppliers offering customized formulations.

Market Opportunities

The expanding biopharmaceutical landscape in South Korea presents an opportunity for BSA suppliers to collaborate with vaccine manufacturers. With multiple COVID-19 vaccine candidates and next-generation biologics under development, there is a growing need for reliable excipients and stabilizers. BSA manufacturers can forge partnerships with contract development and manufacturing organizations (CDMOs) to secure long-term supply agreements, thereby enhancing their market forecast and revenue streams.

Another opportunity lies in the personalized medicine sector, where BSA is used in microfluidic devices and single-cell analysis platforms. As precision diagnostics gain traction, demand for ultra-pure BSA in nanoliter-scale assays is on the rise. Companies that invest in low-volume, high-precision packaging and tailored quality attributes can capitalize on this niche segment. This approach will allow market players to differentiate themselves and capture market opportunities in emerging research applications.

Impact of COVID-19 on South Korea Bovine Serum Albumin Market Growth

Before the COVID-19 pandemic, the South Korea Bovine Serum Albumin (BSA) market exhibited steady market growth driven by predictable demand from research institutes, diagnostics manufacturers, and vaccine developers. Market dynamics at that time were influenced primarily by established supply chains and consistent procurement patterns. Routine laboratory testing and biopharmaceutical production maintained a relatively stable level of market revenue, and industry share was dominated by a handful of suppliers with well‐established distribution networks. Market challenges focused on pricing pressures and a need for continuous innovation to capture incremental market opportunities.

When the pandemic struck, the market experienced both disruption and acceleration. Initial lockdown measures and import–export restrictions led to supply‐chain bottlenecks, causing temporary shortages and delivery delays. At the same time, surging demand for diagnostic kits, serological assays, and vaccine formulation catalyzed a surge in market volume—highlighting the BSA segment’s critical role as a media supplement. This shift in market trends forced companies to reevaluate inventory strategies, strengthen partnerships with domestic manufacturers, and invest in digital supply‐chain monitoring.

Looking ahead, market players are charting new growth strategies by diversifying raw material sourcing to mitigate future shocks. In-depth market analysis reveals that automation in downstream processing, real‐time quality control, and blockchain‐based traceability systems will be key to ensuring resilience. Companies that align future market growth strategies with accelerated R&D collaboration—particularly in monoclonal antibody production and cell culture media—are likely to capture emerging market opportunities. Moreover, continued emphasis on flexible manufacturing units and regional decentralization of production sites will be essential to reducing lead times and buffering against potential disruptions in global logistics.

Geographical Concentration of Value in the South Korea BSA Market

Within South Korea, value concentration in the Bovine Serum Albumin market is heavily skewed toward the Seoul Capital Region, where major research universities, contract research organizations (CROs), and pharmaceutical R&D centers are headquartered. This hub accounts for a significant portion of overall market share due to high demand from clinical diagnostics laboratories and government‐funded biotech projects. The region’s sophisticated infrastructure and close proximity to regulatory bodies also enhance its attractiveness for market players seeking rapid approvals and efficient distribution.

The Gyeonggi Province, adjacent to Seoul, represents another prominent zone, with industrial parks hosting pilot‐scale production facilities and quality control laboratories. Companies in this corridor capitalize on streamlined logistics—benefiting from access to key ports and major highways—thus driving substantial market revenue. Busan’s Free Economic Zone also plays a pivotal role, offering tax incentives and export‐friendly policies that encourage BSA manufacturing for regional markets in Asia. Meanwhile, Daejeon, known for its science and education clusters, contributes meaningfully to the local market scope by supplying specialized analytical services and custom formulation support.

When analyzing market segments, the diagnostics and vaccine development verticals collectively command the highest value, thanks to their reliance on high‐purity BSA grades. As a result, regions with robust analytical capabilities and advanced bioprocessing infrastructure capture a larger slice of the industry size. Emerging biotech corridors, such as those in Incheon’s Songdo district, are also attracting new investments due to favorable regulatory frameworks and proximity to international research consortia. Consequently, these geographic pockets reinforce existing market trends and underscore the importance of regional strengths in shaping long‐term market opportunities.

Fastest-Growing Region in the South Korea BSA Market

While the Seoul Capital Region remains the largest in absolute terms, the fastest‐growing area in the South Korea Bovine Serum Albumin market is the southeastern cluster encompassing Busan, Ulsan, and Daegu. This corridor has experienced rapid expansion owing to targeted local government incentives, streamlined permitting for biomanufacturing facilities, and enhanced connectivity to deep‐water ports. Market insights highlight that new bioprocessing parks in Ulsan are being developed to accommodate single‐use technology lines and high‐throughput purification systems, directly responding to evolving market demands.

Investment flows into Busan’s Free Economic Zone have surged, driven by interest in contract manufacturing for export markets. These developments have spurred regional market growth strategies that prioritize scale-up capacity and compliance with international quality standards. Additionally, Daegu’s emerging Life Sciences Park, supported by public–private partnerships, is fostering R&D hubs focused on regenerative medicine and advanced biologics—areas where BSA plays a crucial role as a stabilizing agent in cell culture applications.

The acceleration in this region is further underpinned by a skilled workforce cohort graduating from nearby universities, offering expertise in downstream processing and analytical method development. Such talent pipelines are key market drivers for both domestic and multinational companies looking to establish local production bases. Current market forecast models predict that this southeastern axis will outpace other regions in terms of compound annual demand growth, reflecting dynamic industry trends and a clear strategic pivot toward diversification of manufacturing footprints. Investments in infrastructure upgrades, cold‐chain logistics, and digital process monitoring tools are all part of the region’s blueprint for sustaining long-term business growth without repeating past supply‐chain pitfalls.

‣ Get More Insights On: South Korea Bovine Serum Albumin Market

‣ Get this Report in Japanese Language: 韓国の牛血清アルブミン市場

‣ Get this Report in Korean Language: 한국소혈청알부민시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

Comments

0 comment