views

India E-Commerce Market 2025: A Valuation of USD 650.4 Billion Predicted by 2033 | IMARC Group

Market Overview 2025-2033

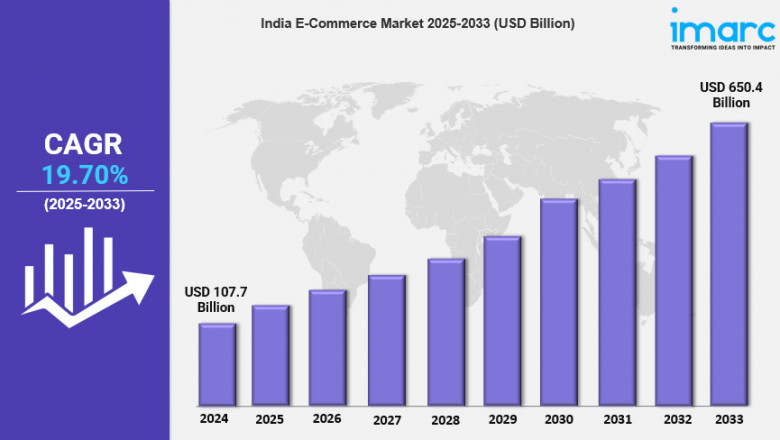

The India e-commerce market size reached USD 107.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 650.4 Billion by 2033, exhibiting a growth rate (CAGR) of 19.70% during 2025-2033. The growing internet penetration, rising smartphone usage, widespread adoption of electronic payment methods, rapid urbanization, and supportive policies introduced by the Government of India (GoI) are key factors driving the market's growth.

Key Market Highlights:

✔️ Rapid expansion fueled by increased digital adoption and smartphone usage

✔️ Rising demand for tailored shopping experiences and curated product selections

✔️ Heightened focus on secure payment methods and safeguarding customer data

Request for a sample copy of this report: https://www.imarcgroup.com/india-e-commerce-market/requestsample

India E-Commerce Market Trends and Drivers:

The e-commerce industry in India is witnessing remarkable growth, fueled by the rapid increase in internet access and widespread smartphone usage. As digital connectivity expands, more consumers are turning to online shopping, leading to a surge in demand across various product categories. The growing comfort with digital payments, supported by secure gateways and intuitive user interfaces, has further accelerated this trend. According to recent insights on the India e-commerce market size, the development of robust logistics and delivery networks has played a pivotal role in supporting this boom, enabling faster and more reliable product deliveries. By 2025, the India e-commerce market share is projected to account for a substantial portion of total retail sales, reshaping consumer habits and opening up new opportunities for businesses of all sizes.

A significant factor highlighted in the India e-commerce market size outlook is the evolving consumer preference for convenience and personalized experiences. Shoppers now expect seamless and customized interactions that align with their individual needs. With the integration of artificial intelligence and advanced data analytics, e-commerce platforms can deliver personalized recommendations, dynamic promotions, and targeted marketing strategies. These innovations not only improve customer satisfaction but also encourage repeat purchases and brand loyalty. As the e-commerce industry in India continues to mature, businesses are expected to increasingly adopt these technologies by 2025 to provide more engaging and relevant shopping journeys.

Another emerging trend transforming the e-commerce industry in India is the rise of social commerce. Social media platforms have become powerful tools for product discovery, consumer engagement, and brand building. Influencer marketing and user-generated content are playing key roles in enhancing brand trust and visibility. This shift has prompted businesses to incorporate social commerce strategies alongside traditional e-commerce approaches. By 2025, the integration between social platforms and e-commerce is expected to deepen, allowing brands to tap into large, active user bases to drive sales and engagement. This convergence will redefine how consumers connect with brands and shop online, making it a cornerstone of the evolving India e-commerce market share.

India E-Commerce Market Future Outlook

As India moves toward a digital-first economy, emerging technologies such as artificial intelligence, augmented reality, and blockchain are poised to greatly elevate the online shopping experience. By 2025, the integration of these innovations is expected to streamline operations, deliver deeper personalization, and strengthen security for consumers. Meanwhile, the rapid rise of social commerce and influencer marketing is reshaping e-commerce dynamics, creating fresh opportunities for customer engagement and sales growth. With businesses increasingly adopting these trends, the e-commerce market in India is set for remarkable expansion, driven by both established players and a wave of innovative startups.

E-Commerce Industry Analysis in India:

- Major Market Drivers: India's e-commerce market growth is chiefly driven by the mass penetration of smartphones and enhanced internet connectivity, accompanied by the growing ease of online transactions. The expansion of online shopping is further aided by demographic drivers such as a youth population and rising disposable incomes.

- Major Market Trends: The India e-commerce market is also experiencing tremendous growth in the fields of AI-driven personalized shopping experience, social commerce on platforms including Facebook and Instagram, and increasing demand for sustainable and eco-friendly products. The India e-commerce demand is also rising as a result of integrating newer technologies like AR and VR to give a more enhanced shopping experience, which is becoming a popular trend among shoppers.

- Challenges and Opportunities: E-commerce in India faces challenges such as supply chain inefficiencies, regulatory hurdles, and intense competition from both local and international players. However, these challenges also open opportunities for innovation in logistics, customer service, and product diversification. There is also significant potential in untapped rural markets, which could drive the next wave of e-commerce growth in India.

Speak to an analyst : https://www.imarcgroup.com/request?type=report&id=5798&flag=C

India E-Commerce Market Industry Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

- Home Appliances

- Apparel, Footwear and Accessories

- Books

- Cosmetics

- Groceries

- Others

Breakup by Transaction:

- Business to Business (B2B)

- Business to Consumer (B2C)

- Consumer to Consumer (C2C)

- Others

Breakup by Payment Mode:

- Cash Payment

- Bank Transfer

- Card Payment

- Digital Wallet

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Various top players in market:

- Ajio

- com Inc

- Flipkart India Private Limited

- Naaptol Online Shopping Pvt. Ltd

- Nykaa E-Retail Pvt. Ltd

- Purplle

- Shopclues (Clues Network Pvt. Ltd.)

- Snapdeal Limited

- Tata Cliq (Tata Group)

India E-Commerce Market News:

- March 2025: Amazon Web Services made a significant investment of $8.2 billion in Maharashtra over the next few years to scale up its cloud infrastructure. This action boosts India's expanding cloud market, expected to reach $24.2 billion by 2028, and features high-tech deployment and creation of substantial local job opportunities.

- February 2025: Shein has re-entered India under the radar as a separate app, which was introduced by Reliance Retail. Close to five years since it was banned, Shein's re-entry-through-a-tech-partnership aims at India's value fashion space with intentions to locally manufacture and globally export under the brand label.

- January 2025: DGFT stated that India's first e-commerce export hub will start functioning by March to increase exports to $100 billion by 2030. The pilot includes companies such as Shiprocket and DHL. A new Diamond Imprest Authorisation scheme for duty-free import of diamonds will roll out from April 1.

- December 2024: Amazon introduced trials of 15-minute grocery deliveries in India entering India's expanding quick commerce space. It will be competing with Swiggy Instamart and Blinkit to capture growing demand for ultra-speed delivery of everyday items across city hubs.

- December 2024: Amazon is speeding up the rollout of its fast commerce service, Tez, in India, earlier than its original Q1 2025 timeline. The move is strategic as it seeks to grab a slice of India's fast-growing quick commerce market, which is currently dominated by Blinkit, Zepto, and Swiggy Instamart.

- December 2024: Amazon introduced in a pilot for its 15-minute fast commerce offering in Bengaluru, entering India's burgeoning ultra-fast delivery market. The business has not publicly revealed further expansion plans. Plans for rollout will depend on success in Bengaluru. The offering differs from Amazon's current two-hour Amazon Fresh.

- August 2023: Walmart has paid USD 1.4 billion to buy out hedge fund Tiger Global investment in its Indian e-commerce firm Flipkart and acquired private equity firm Accel's remaining 1% stake. The transaction brings the value of the e-commerce firm to $35 billion from nearly $38 billion after it sold its shares to Japan's SoftBank, US retailer Walmart and other investors in 2021.

Trending Reports By IMARC Group:

India Furniture Market: https://www.imarcgroup.com/india-furniture-market

India Electric Vehicle Market: https://www.imarcgroup.com/india-electric-vehicle-market

India Drones Market: https://www.imarcgroup.com/india-drones-market

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion. IMARC's services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment