views

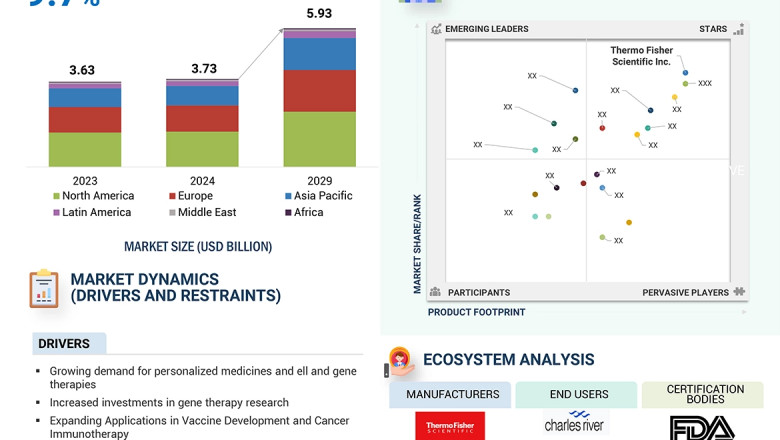

The global gene transfer technologies market, valued at US$3.63 billion in 2023, is forecasted to grow at a robust CAGR of 9.7%, reaching US$3.73 billion in 2024 and an impressive US$5.93 billion by 2029. The major factors contributing to the growth of the gene transfer technologies market include the growing demand for personalized medicines and cell and gene therapies and investments in gene therapy research. Furthermore, the expanding applications in vaccine development, and cancer immunotherapy in the market is likely to drive market adoption in the coming years.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=74062902

Browse in-depth TOC on "Gene Transfer Technologies Market"

771 - Tables

56 - Figures

524 - Pages

The product segment is segmented into instruments, consumables, reagents, kits & assays, and other products. The reagents, kits & assays gene transfer technologies segment dominated product segments owing to various factors such as increasing adoption of gene therapies and cell therapies across pharmaceutical and biotech research. The consumables segment is anticipated to grow at a significant CAGR owing to increase in the activities for research and development in genetic engineering is rising the demand for good quality laboratory materials. The product segment is segmented into instruments, consumables, reagents, kits & assays, and other products. The reagents, kits & assays gene transfer technologies segment dominated product segments owing to various factors such as increasing adoption of gene therapies and cell therapies across pharmaceutical and biotech research. The consumables segment is anticipated to grow at a significant CAGR owing to the surge in research and development activities in genetic engineering, propelling the need for high-quality laboratory materials.

The gene transfer technologies market is segmented by mode into viral and non-viral vector. The viral segment dominated the market in 2023. The segment's dominance is attributable to increasing technological developments for cell-based therapies, rising demand for cell and gene therapies, fueled by as a preferred mode of gene delivery. Furthermore, the increasing prevalence of chronic and rare diseases, enhances the adoption of viral vectors. Additionally non-viral vector is also quickly gaining market share due to potential of non-viral systems for precise, targeted genetic modifications without the risks posed by viral vectors. This factor drives the growth of the non-viral segment.

Based on the method, the market is divided into ex vivo, in vivo and in vitro. The in vivo method dominated the market in 2023 owing to increased prevalence of genetic disorders and chronic diseases that could heighten demand for innovative therapeutic solutions. Ex vivo method is likely to grow at faster pace owing to commercial success of therapies such as CAR-T cell therapy and stem cell-based treatments for genetic disorders.

The application segment is segmented into research, therapeutics, and other applications. The therapeutics application segment dominated application segment in 2023. An increased investment in gene therapies, rising chronic diseases, and need for new approaches in treating these diseases, as well as the advancement of delivery methods which enhance efficacy and safety are supposed to contribute to the growth of this market.

The end-user market is categorized into the pharmaceutical & biotechnology companies, academic & research institutes and other end users. The pharmaceutical & biotechnology companies dominated the segment in 2023; the academic & research institutes are likely to grow at a significant CAGR. Favourable regulatory support and strategic partnerships with biotech companies contribute to the growth of end user market.

The gene transfer technologies market is split into several regions, such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2023, North America held the largest market share. Moreover, the Asia Pacific region is projected to experience the fastest growth, with a notable compound annual growth rate (CAGR) expected over the forecast period. The growth of the Asia Pacific region is attributable to the increasing investments in biotechnology & pharmaceutical research and rising involvement of pharmaceutical & biotechnology companies. Furthermore, increasing number of collaborations between local and global biotech firms fueling the growth of market.

Request Sample Pages : https://www.marketsandmarkets.com/requestsampleNew.asp?id=74062902

The market for gene transfer technologies market is competitive. Prominent players in the gene transfer technologies market are Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Merck KGaA (Germany), Qiagen (Netherlands), Sartorius AG (Germany), Bio-Rad Laboratories Inc. (US), Revvity (US), Agilent Technologies, Inc (US), Genscript (US) and Bio-Techne (US) and among others.

Thermo Fisher Scientific is one of the leaders in gene transfer technologies with extensive product range. The major strengths of the company include diversified product portfolio, strong geographic presence, adoption of organic & inorganic growth strategies and strong emphasis on launching new products in the market contributes to maintaining its dominant position. For instance, in November 2022, Thermo Fisher launched the Gibco CTS AAV-MAX Helper-Free AAV production system to meet clinical and commercial demands for cost-effective and scalable development of adeno-associated virus (AAV)-based gene therapies.

Danaher Corporation is one of the dominant players in the global gene transfer technologies market, The company offers various gene transfer technologies through its subsidiary, Cytiva. The company became one of the key players in the biotechnology industry by acquiring Pall Corporation in August 2015 for USD 13.8 billion and the Biopharma business (Cytiva) of GE Healthcare in March 2020 for USD 21 billion. The company focuses on strategic alliances, mergers, and new product introduction. For example, in September 2024, Danaher unveiled the RNA delivery LNP kit specifically designed for use with the NanoAssemblr Ignite and Ignite+ systems, which expands the GenVoy-ILM product line to speed mRNA and saRNA vaccine development.

Merck KGaA is also one of the leading firms in gene transfer technologies market. The company operates in the gene transfer technologies market through its life science business segment. The company's leading position is attributable to its diversified product portfolio, strong geographic presence, and adoption of organic and inorganic growth strategies. For instance, in August 2024, Merck KGaA acquired Mirus Bio (US) to advance Merck's integrated offering for viral vector manufacturing.

For more information, Inquire Now!

Comments

0 comment