The introduction of cutting-edge digital tools and technologies has revolutionized the business ecosystem in the last few years. As in any other industry, Property Management is also enjoying the benefits of these innovations. Whether you’re a property manager or landlord, using suitable software can simplify managing your properties. Imagine doing your job without a computer now. Seems impossible, isn’t it? Going back to the traditional pen-and-paper method is practically unimaginable today. Considering the ease of operation a simple spreadsheet brings to your processes, think of all the benefits you will be getting from the advanced tools. However, it is okay to have concerns. And we are here to help you with them. Does your business already work with QuickBooks desktop integration software? Then you are halfway there. This popular accounting software can help you with property management. But the question is, how? Read on to find the answers.

Before we delve into the explanation, let us find out a little more about the software.

What is QuickBooks?

QuickBooks is arguably the leading accounting software in today’s time. A full-featured business and financial management suite complete with tools for accounting, inventory, payroll, tax filing, invoicing, bank account tracking and reconciliation, expense management, budgeting, payment processing, accounts receivable and accounts payable management, and many more functionalities, QuickBooks takes care of all your accounts and bookkeeping tasks with unbelievable ease.

That feature set is not a complete list of what QuickBooks can do. It can also plug into many additional software tools for added features. QuickBooks can be regarded as the Swiss Army Knife of business financial tools—it can do just about anything you might need for your business, including property management.

QuickBooks offers both a desktop version for a fixed fee as well as QuickBooks online integration version accessible through your web browser, tablet, or smartphone for a monthly or yearly subscription. Some features, such as payroll management and payment processing, incur an additional fee regardless of which version you choose.

Is QuickBooks the Right Tool for Property Management?

If you feel like your property management endeavor requires more holistic property management software, this leads to more concerns. All your financial systems work with QuickBooks, and you don’t want to switch. Will make a change from QuickBooks to a new property management system force you to run two parallel software programs to manage customer needs with those of the business? The decision rests on how well each type of software works for your specific business needs and whether you can integrate the different software systems.

The task is not as confusing to your respite as it might sound, and QuickBooks can take care of both tasks seamlessly. To explain, can QuickBooks work as a property management software? The short and simple answer is yes. QuickBooks does have the capacity to be used for managing rental property accounting transactions. The software lets you set up properties as customers, tenants as sub-customers, and classes to track various transaction types. Specifically, it is best used by a property manager handling small to midsize properties.

Benefits of QuickBooks for Property Management

-

- Efficient Financial Management

QuickBooks for Property Management provides a centralized platform for efficiently managing financial transactions related to property management. It helps in tracking rental income, property expenses, and other financial transactions in an organized manner. This ensures accurate and up-to-date financial records.

-

- Streamlined Rent Collection

The software facilitates easy rent collection by allowing property managers to set up automatic rent payments and generate invoices. This reduces the likelihood of missed payments, streamlining the entire rent collection process and ensuring a steady cash flow.

-

- Expense Tracking and Reporting

QuickBooks enables property managers to track and categorize various expenses associated with property management, such as maintenance costs, utilities, and property taxes. The detailed expense tracking feature aids in generating comprehensive financial reports for better decision-making.

-

- Bank Reconciliation

The bank reconciliation feature in QuickBooks helps property managers match transactions between their bank statements and the software. This ensures accuracy in financial records and provides a clear overview of the property’s financial health.

-

- Automated Financial Reporting

QuickBooks offers a range of pre-built templates and customizable reports, making it easier for property managers to generate financial reports, including profit and loss statements, balance sheets, and cash flow statements. Automation saves time and ensures accuracy in reporting.

-

- Tenant Management

With QuickBooks, property managers can maintain detailed tenant profiles, including contact information, lease agreements, and payment histories. This information can be easily accessed, helping property managers make informed decisions regarding tenant relationships and lease renewals.

-

- Tax Preparation Made Easy

QuickBooks simplifies the tax preparation process for property managers by categorizing income and expenses, generating necessary financial reports, and providing a clear audit trail. This helps reduce the time and effort required during tax season.

-

- Integration with Other Software

QuickBooks seamlessly integrates with various property management tools and applications, enhancing its functionality. This integration can include property management software, payment processors, and other tools that contribute to a more comprehensive property management solution.

-

- Scalability

QuickBooks is scalable, making it suitable for property managers overseeing a single property or managing a diverse portfolio. As the property management business grows, QuickBooks can easily adapt to the increasing complexity and volume of transactions.

-

- User-Friendly Interface

The user-friendly interface of QuickBooks makes it accessible to individuals with varying levels of financial expertise. Property managers can quickly learn and navigate the software, reducing the learning curve and allowing them to focus more on effective property management rather than complex financial processes.

How Do You Use QuickBooks for Property Management?

The first and most important thing to get right in QuickBooks is to make sure you set up two separate company files:

Your business: This is your property management business, where you accept payment for your services and issue payments to owners, etc.

Your service: This is your rental property management service, including collecting rent payments, accepting security deposits, paying for maintenance and repairs, other fees, and anything else involved in managing the properties for your owners.

Therefore, It is vital that you keep these two parts of your business separate. Your accounting reports will be muddled if you don’t, and it will be virtually impossible to distill out any valuable insights. Once you get this done, you will need to go through these steps to use QuickBooks for essential property management accounting functions, including setting up your property and tenants and recording transactions in QuickBooks.

Setting Up Your Property Management Company File in QuickBooks

Step 1: Set Up Each Property Owner as a Customer

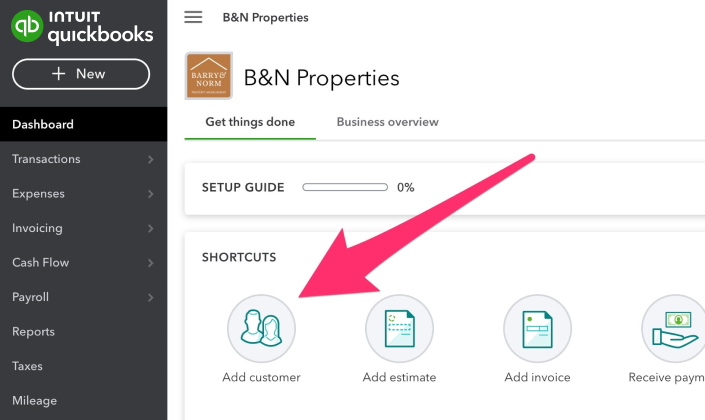

- On the QuickBooks dashboard, click on “Add customer” under the shortcuts section.

- Next, plug in all your client’s information.

- Then click “Save” and repeat these steps for the rest of your clients.

Step 2: Add Your Accounts

- Start by going to your chart of accounts, which you can get to by clicking on the sidebar under “Accounting.”

- Then, click “New” to create a new account.

- Next, select the proper primary account from your chart of accounts. QuickBooks will automatically create one for you, but it may not be ideally suited for property management. So, you will have to name and describe it in an easily identifiable way.

- Once you’ve finished creating your accounts, you’ll be able to view them on the chart of accounts page. Make sure to do this for all relevant accounts. This could include assets such as equipment, liabilities such as payroll, and expenses such as utilities, rent, and insurance.

Step 3: Add Your Service(s)

This is where you prepare to create and send invoices. To do this, you will need to create a service first. Once you set up your services, go on to

- Click on “Invoice” on the sidebar menu

- Next, click on the “Products and Services” navigation item at the top right

- Then, click “New.”

- Fill in the service name

- Hit save

Step 4: Create Invoices and Record Income

At this stage, you are ready to generate invoices and accept payments. To do that, you will have to go back to the main dashboard. Once you are there:

- Click on “Add Invoice”

- Your customer information will already be on QuickBooks by this point

- Next, click on the customer drop-down menu

- Select the client you’re billing

- Input the amount

- Add any additional notes, if required

- Finally, hit send

Once you receive the payment, do not forget to click on the invoice again and select “Receive payment” so it reflects in QuickBooks.

Setting Up Your Rental Property Management File in QuickBooks

Next, let’s set up the company file you’ll use to manage your properties. As mentioned earlier, you’ll use this company file to record all transactions related to the properties you manage. This includes:

- Collecting rent payments

- Collecting other payments and fees such as pet rent, parking fees, etc.

- Recording security deposits

- Paying for maintenance, repairs, and upgrades

- And more

To manage these, go through the following steps:

Step 1: Set Up Properties

- Since QuickBooks is not designed for property management, there is no way to add properties specifically. Instead, you’ll need to add each property as a customer.

- Once again, click on “Add customer.”

- Then, fill in the property information (just a name or address will suffice)

Step 2: Set Up Tenants

To add tenants, you’ll need to once again go back to your dashboard, click “Add customer,” and input their information to add each tenant as an individual customer.

Step 3: Set Up Property Owners as Vendors

- From the main menu, navigate to “Expenses” then to “Vendors,”

- Next, click on “Add vendor manually.”

- Click “Save”

Step 4: Set Up Accounts and Services

- Navigate to “Accounting”

- Select “Chart of accounts” from the menu

- Click “New” to create a new account

- Select the proper primary account from your chart of accounts

Once you’ve done this, you can start collecting rent payments by creating invoices, just like we did in the last section.

How Do Landlords Use QuickBooks?

Desktop versions of Quickbooks will allow you to set up company and customer files as various properties. This will allow you to handle tasks such as collecting rent from tenants and paying property owners and management companies on top of any fees involved in property maintenance.

One of the most notable features of QuickBooks involves income tracking, where landlords can input and categorize rental payments from tenants. QuickBooks allows landlords to set up recurring invoices, automate rent collection, and track payment history. This helps in maintaining a clear record of rental income, facilitating a more organized and efficient approach to financial management. Additionally, landlords can easily generate reports such as profit and loss statements, providing a comprehensive overview of their property’s financial health and assisting in making informed decisions.

Another crucial aspect is expense tracking. Landlords can record property-related expenses such as maintenance, utilities, property taxes, and mortgage payments. QuickBooks enables the categorization of expenses, making it simpler for landlords to analyze spending patterns and identify areas for potential cost-saving. The software’s bank reconciliation feature ensures that all transactions align with bank statements, minimizing the chances of errors. By using QuickBooks, landlords not only manage day-to-day finances effectively but also simplify tax preparation by generating accurate and detailed financial reports, ensuring compliance with tax regulations, and optimizing deductions where applicable. Overall, QuickBooks offers landlords a comprehensive and user-friendly platform to enhance financial control and efficiency in property management.

Limitations of QuickBooks as A Rental Property Management Software

Although QuickBooks is one of the most popular accounting software systems for small and medium businesses, it has some major limitations if you want to use it as a standalone software program for rental property management. For example:

-

- Limited Property-Specific Features

QuickBooks, while versatile, is not specifically designed for property management. It lacks certain features crucial for rental property management, such as tenant communication tools, lease tracking, and maintenance request management. Users might find themselves supplementing QuickBooks with additional software or manual processes to fulfill these specific property management needs.

-

- Scalability Challenges for Large Portfolios

QuickBooks may face scalability challenges for landlords or property managers overseeing a large number of rental units. As the portfolio grows, the software’s capacity to efficiently handle the increasing volume of transactions and data might be limited. This could lead to slower performance and potential data management issues.

-

- Complexity for Novice Users

While QuickBooks is user-friendly, its robust features and financial terminology may be overwhelming for landlords with limited financial expertise or those who are new to property management. Novice users may find it challenging to set up and utilize the software to its full potential without sufficient training or assistance.

-

- Inadequate Tenant Communication Tools

QuickBooks lacks built-in tools for effective tenant communication. Managing lease agreements, sending automated rent reminders, and handling maintenance requests directly within the software are features that property managers often need but are not included. Landlords might need to rely on additional communication platforms to address these aspects efficiently.

-

- Dependence on Manual Data Entry

While QuickBooks offers some automation features, certain aspects of property management, such as tracking maintenance expenses or categorizing specific costs, may still require manual data entry. This can be time-consuming and increases the likelihood of errors, particularly in situations where there is a high volume of transactions or complex financial arrangements associated with the rental properties.

Field Service Software vs. QuickBooks for Property Management

Taking into consideration the above mentioned limitation, field service software is often a more comprehensive solution for rental property management compared to relying solely on QuickBooks. Unlike QuickBooks, field service software is specifically designed to meet the unique needs of property managers. It typically includes features such as lease tracking, maintenance request management, and tenant communication tools. This specialized functionality allows property managers to streamline their operations and handle all aspects of property management on a single platform, reducing the need for additional tools and manual processes. This can result in increased efficiency, better organization, and improved overall management of rental properties.

Moreover, field service software often offers scalability that is better suited for property managers overseeing a large portfolio. As the number of rental units increases, field service software can handle the growing volume of transactions and data more effectively than QuickBooks. It provides a more robust platform for managing diverse properties and tenants, offering features like automated rent reminders, integrated communication channels, and detailed lease tracking. The user-friendly interface of field service software also caters to property managers with varying levels of financial expertise, making it easier for individuals to navigate and utilize the software to its full potential. Overall, the specialized nature and scalability of field service software make it a superior choice for rental property management, addressing the limitations posed by using QuickBooks alone.

Field Promax: The Comprehensive Software System for Property Management

Field Promax stands out as a superior choice for rental property management compared to QuickBooks due to its specialization in the field service industry. Unlike QuickBooks, Field Promax is tailored specifically for property management, offering a comprehensive suite of features that cater to the unique needs of landlords and property managers. It provides tools for lease management, tenant communication, and maintenance request tracking, streamlining day-to-day operations seamlessly. The software’s specialized features allow users to handle lease renewals, rent collection, and property maintenance efficiently within a single platform, reducing the need for additional software or manual processes.

Moreover, Field Promax’s scalability and customization options make it an ideal choice for property managers overseeing various portfolios or dealing with a growing number of rental units. The software adapts to the expanding needs of property management businesses, offering robust solutions for users with diverse property portfolios. Unlike QuickBooks, which may face limitations in handling large-scale property management operations, Field Promax is designed to efficiently manage complex and extensive rental property portfolios, ensuring that property managers can focus on strategic decision-making rather than being hindered by software constraints. Overall, Field Promax’s specialization and tailored features make it a more comprehensive and efficient solution for rental property management compared to the more general-purpose QuickBooks.

Keep in mind that this isn’t a comprehensive guide to getting started with QuickBooks but more of a starting point to show you how to get going and help you decide if QuickBooks is right for you. Several additional steps and several more hours are likely necessary to optimize your QuickBooks integration software so that you can use it for everything you’ll need. With that being said, we hope this guide helps you get things off the ground faster and easier, especially if you’re just getting started.

For more information and resources, Contact Us Here.