views

Histology & Cytology Market Size & Trends

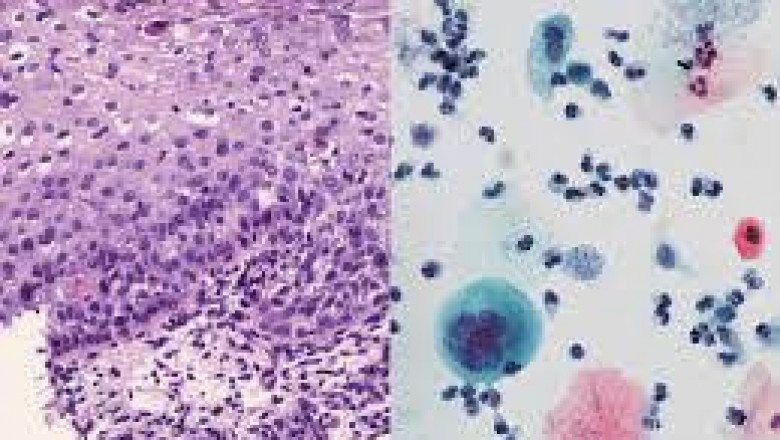

The global histology and cytology market is poised for significant growth, with an estimated USD 21.13 billion in size by 2024. A compound annual growth rate (CAGR) of 15.31% from 2025-2030 is anticipated, driven primarily by the rising incidence of chronic diseases like cancer. Advances in technology and a surge in new product launches are also expected to contribute positively to market expansion. Furthermore, favorable reimbursement policies and government-led initiatives aimed at developing healthcare infrastructure are likely to further propel growth by 2030.

The rapidly evolving histology and cytology industry is set to experience substantial growth, driven by innovative technologies and regulatory approvals that significantly enhance diagnostic precision and speed. For example, in February 2024, Hologic, Inc. secured FDA clearance for its Genius Digital Diagnostics System, a groundbreaking digital cytology system that seamlessly integrates artificial intelligence with advanced volumetric imaging. This pioneering solution allows for more accurate detection of pre-cancerous lesions and cervical cancer cells, ultimately contributing to improved early diagnosis and patient outcomes. Similarly, QIAGEN introduced the QIAstat-Dx Gastrointestinal Panel 2 and Meningitis/Encephalitis Panel in January 2024, expanding its portfolio while maintaining its existing Respiratory SARS-CoV-2 Panel. The QIAstat-Dx system harnesses multiplex real-time PCR to simultaneously detect multiple pathogens, providing critical Ct values and amplification curves that facilitate more informed clinical decision-making. These breakthroughs underpin the increasing adoption of AI-driven diagnostics and multiplex molecular testing, driving market expansion while prioritizing patient-centered care for communicable diseases.

The increasing recognition of immunohistochemistry as a valuable diagnostic tool is driving market growth for histology and cytology services, as it provides an advanced understanding of cellular components to diagnose various diseases, including infectious agents and cancers. Several companies are investing heavily in developing cutting-edge solutions for immunohistochemistry, which is likely to fuel further expansion. For example, Aiosyn, a prominent provider of AI-based digital pathology solutions, recently expanded its AI-powered module to enhance the capabilities of immunohistochemistry staining, positioning itself well for future market success.

The rising incidence of cancer and related health issues is also anticipated to drive market expansion over the forecast period. Given that cancer diagnosis largely depends on histological and cytological tests to identify the type, stage, and progression of the disease, an increase in cancer cases will likely have a favorable impact on the market. For example, based on data published by the National Library of Medicine, approximately 1.9 million new cases and 609,820 deaths are estimated to occur in the United States alone due to cancer in 2023.

Technological advancements in the field have significantly contributed to market growth, transforming the way histological and cytological examinations are conducted. The integration of automated systems, digital imaging techniques, and computer-assisted analysis has substantially improved examination accuracy and efficiency. As a result, diagnostic capabilities have been enhanced, while turnaround times have been reduced, ultimately leading to increased adoption by healthcare professionals.

The growing recognition of the importance of early disease detection and preventive care has led to a significant increase in demand for histology and cytology services. As a result, cervical, breast, and other types of cancer screenings have become more frequent, driving market expansion. Furthermore, the ageing population is resulting in a rise in chronic diseases, further fueling the need for histopathological and cytopathological analysis. The growth of the industry can also be attributed to advancements in healthcare infrastructure in developing regions. Improvements in medical facilities, enhanced accessibility to advanced diagnostic services, and government initiatives aimed at enhancing cancer screening programs have all contributed to the market's continued expansion.

Market Concentration & Characteristics

The histology and cytology sector is witnessing a remarkable surge in innovation, fueled by groundbreaking advancements in digital pathology, artificial intelligence, and molecular diagnostics. Cutting-edge technologies such as AI-driven image analysis, next-generation sequencing (NGS), and automated slide processing are significantly boosting diagnostic accuracy and productivity. Furthermore, the emergence of liquid biopsy techniques, multiplex biomarker assays, and novel staining methods is transforming early disease detection and personalized medicine approaches.

The histology and cytology sector has seen a notable uptick in mergers and acquisitions, driven by the pursuit of expanding diagnostic capabilities and leveraging cutting-edge technology. Industry leaders are acquiring innovative AI-driven pathology firms, molecular diagnostics companies, and reagent manufacturers to bolster their market position and stay ahead of the curve. Strategic partnerships and collaborations are also facilitating geographic expansion, particularly in emerging markets and digital pathology segments, resulting in a wave of industry consolidation and accelerated innovation.

Regulations have a profound impact on the histology and cytology industry, influencing both laboratory procedures and patient outcomes. Agencies such as the FDA, EMA, and WHO exert significant influence over the adoption of new technologies, particularly in AI-driven digital pathology and molecular diagnostics. Adhering to evolving guidelines not only ensures compliance but also fosters credibility and market acceptance, ultimately driving innovation and quality improvements in diagnostic solutions that improve patient care and outcomes.

In the field of histology and cytology, emerging technologies are transforming the diagnostic landscape. Liquid biopsy, molecular diagnostics, and AI-driven imaging solutions provide non-invasive or faster diagnostic options, complementing traditional methods. Next-generation sequencing (NGS) and PCR-based tests are also gaining traction, offering more efficient alternatives to tissue-based approaches. While these advancements hold promise, histology and cytology remain the gold standard for definitive diagnosis, ensuring a steady demand for these laboratory services despite the rise of innovative technologies.

The histology and cytology industry is experiencing a substantial surge in global reach, driven by rising cancer cases, escalating healthcare investments, and enhanced diagnostic capabilities in emerging markets. Companies are expanding their presence in Asia-Pacific, Latin America, and the Middle East through strategic partnerships, acquisitions, and regulatory approvals. Despite North America and Europe maintaining their market dominance, rapidly developing regions are increasingly adopting advanced diagnostic solutions, propelling growth and expansion within the industry.

Type of Examination Insights

The cytology segment dominated the market in 2024, accounting for 72.20% of the revenue share. As the forecast period progresses, this trend is likely to continue, driven by the integration of Artificial Intelligence (AI) technology. For example, Synergy Laboratories, a prominent full-service diagnostic laboratory, recently launched Hologic's Genius Digital Diagnostics System in the Gulf Coast region. This advanced system combines deep-learning-based AI with volumetric imaging technology, significantly improving the detection of precancerous lesions and cervical cancer cells. By setting new standards for precision medicine, companies are elevating diagnostic accuracy and efficiency for healthcare providers.

The cytology segment is gaining momentum thanks to the growing adoption of advanced biomarker-based diagnostics and regulatory endorsements. Roche’s CINtec PLUS Cytology test, a FDA-approved and CE-marked dual-stain test for triaging HPV-positive cervical cancer screening results, has garnered global recognition, including inclusion in WHO cervical cancer prevention guidelines and recommendations from ASCCP. By enhancing the detection of cervical precancer, this technology reduces unnecessary colposcopy procedures while enabling earlier intervention for high-risk individuals, thereby boosting diagnostic accuracy and patient outcomes. This is driving the integration of dual-stain cytology into cervical cancer screening programs, propelling the growth of the cytology market.

Get A Free Sample Research Report PDF

https://www.theresearchinsights.com/reports/histology-and-cytology-market-472/request-sample

Product Insights

The consumable and reagents segment accounted for a substantial 60.49% of the revenue share in 2024, with an anticipated continuation of its leadership through 2025 to 2030. Within this segment, multiple consumables play critical roles in the histology and cytology process, including tissue sample containers, kits, stain reagents, fixative solutions, medium reagents, and other reagents. The dominant position attributed to this segment can be largely attributed to the routine adoption of these consumables across various industries. Furthermore, companies are investing in cost-effective solutions such as kits and reagents, bolstering the market's growth for histology and cytology applications.

The market is witnessing a significant expansion, fueled by breakthroughs in genomic profiling and the growing need for efficient, decentralized molecular testing solutions. In November 2024, Biofidelity introduced Aspyre Lung Reagents (research use only) for liquid biopsy samples, revolutionizing next-generation sequencing (NGS) for identifying non-small cell lung cancer (NSCLC) biomarkers with a groundbreaking approach. Aspyre Lung enables the detection of both DNA and RNA biomarkers from tissue and blood samples in just four simple steps, utilizing existing qPCR platforms to facilitate global laboratory integration. Its exceptional capabilities make it suitable even with challenging samples, providing fast, simplified, and decentralized testing that's driving demand for innovative reagents. This is accelerating the adoption of Simplified Genomic Profiling (SGP) and contributing to growth in the histology and cytology industry.

Application Insights

The drug discovery and designing segment has emerged as the market leader, commanding a substantial 47.56% share of the overall revenue in 2024. This dominant position is anticipated to persist throughout the forecast period, driven by the extensive adoption of histomorphometry and IHC staining techniques in pharmaceutical and biotechnology companies for drug development purposes.

The clinical diagnostics segment is poised to experience a remarkable growth trajectory, driven by the escalating demand for histopathology studies in cancer diagnosis. By meticulously extracting cells and tissues from suspicious lump sites, these diagnostic tools enable healthcare professionals to pinpoint abnormalities and malignancies with unprecedented precision. Their widespread adoption has led to a significant rise in screenings for various types of cancers, including breast, bowel, and cervical cancer, ultimately contributing to enhanced patient outcomes.

Regional Insights

The North American histology and cytology industry boasts a significant presence globally, accounting for 39.82% of the market share in 2024. This dominance is attributed to the region's well-established pharmaceutical and medical device sectors, which provide a robust foundation for innovation and growth. The industry's focus on embracing emerging technologies, such as automation and artificial intelligence (AI), has proven to be a key driver of its success. Recent events, including the 76th Annual American Congress of Clinical Chemistry and Exposition of Clinical Laboratory Medicine, have further underscored the growing global interest in advanced diagnostic solutions. This event, held in July-August 2024, attracted over 20,000 professionals from 110 countries, highlighting the industry's commitment to delivering high-quality diagnostics. The introduction of cutting-edge products by Wondfo Biotech is a notable example of this trend. The company's new product launches, including the FC-2100 fully automatic chemiluminescence immunoassay analyzer, Finecare FIA Meter X1 and X2, and Ucare-6000 automatic blood gas analyzer, demonstrate the industry's shift toward automation, efficiency, and high-throughput diagnostic solutions. As laboratories across North America strive to enhance diagnostic accuracy, workflow efficiency, and

U.S. Histology And Cytology Market Trends

The US histology and cytology industry is witnessing significant expansion due to the integration of advanced technologies. For example, in January 2025, Molecular Instruments introduced HCR Gold and HCR Pro, upgrading its HCR imaging platform to support dual-modality assays for simultaneous RNA and protein visualization. This innovation is enhancing the ability to visualize samples with high-resolution while preserving morphology in both manual and automated workflows. As a result, these advancements are bolstering biopharma drug development and academic research. The increasing adoption of cutting-edge imaging solutions is further propelling growth in the US market by accelerating breakthroughs in disease diagnostics, biomarker discovery, and precision medicine.

Europe Histology And Cytology Market Trends

In Europe, a thriving histology and cytology industry fuels the adoption of molecular automation technology (MAT). Germany, Italy, and France are at the forefront of this market, driven by strategic collaborations and Original Equipment Manufacturer (OEM) partnerships. Notably, Sysmex Corporation and Siemens Healthineers recently formed a global OEM agreement, which led to their independent distribution of combined hemostasis testing solutions in the US and EU countries. This move not only enhances laboratory efficiency but also automates clinical diagnostics, as lab personnel can focus on more complex tasks. As European labs increasingly embrace advanced hemostasis and cytology solutions, demand for high-performance reagents, imaging systems, and automated diagnostic workflows is expected to surge, fueling market growth across the region.

The French histology and cytology industry is experiencing significant momentum driven by cutting-edge digital pathology solutions and strategic acquisitions. In March 2025, Epredia secured U.S. FDA 510(k) clearance for its E1000 Dx Digital Pathology Solution, a pioneering whole-slide imaging system that can process up to 1,500 tissue samples daily, dramatically enhancing laboratory efficiency and cancer diagnostics capabilities. Following this milestone, Epredia further solidified its presence in the French anatomical pathology market through its acquisition of Microm Microtech France and Laurypath in 2022, bolstering its European diagnostic footprint. As digital pathology and AI-driven imaging solutions continue to gain traction in France, the demand for automated, high-throughput histology and cytology technologies is poised to surge, fueling market growth.

The German histology and pathology industry is driven by a thriving pharmaceutical sector, which plays a pivotal role in shaping the European market. The country's growth of specialized service providers has been notable, with companies like StageBio leading the way. In November 2024, StageBio relocated its European division to a cutting-edge facility in Freiburg, Germany, bolstering its capacity to support preclinical and clinical research. This new facility boasts advanced resources, an expanded workspace, and a team of over 125 experts dedicated to delivering high-quality GLP-compliant histology, pathology, image analysis, and archiving services. As Germany solidifies its position as a leading hub for biomedical research and pharmaceutical development, the demand for specialized histopathological analysis, automated imaging solutions, and regulatory-compliant laboratory services is anticipated to rise, driving market expansion and growth.

Asia Pacific Histology And Cytology Market Trends

The Asia Pacific histology and pathology industry is witnessing a substantial surge due to the proliferation of advanced diagnostic laboratories and the integration of innovative technologies. In January 2025, Ampath, in conjunction with Parashar Pathology Clinic, inaugurated a cutting-edge pathology laboratory in Meerut, India, further solidifying its commitment to delivering comprehensive diagnostic services across the region. With state-of-the-art technology and an extensive menu of over 2,500 diagnostic tests, including cytology, histopathology, immunohistochemistry, molecular diagnostics, and next-generation sequencing (NGS), this facility exemplifies the increasing demand for precise and automated pathology solutions. As healthcare infrastructure in the Asia-Pacific region continues to expand and modernize, the pressing need for swift and accurate disease diagnostics is poised to drive market growth.

The histology and cytology industry in Japan is driven by significant advancements in noninvasive diagnostic technologies and robust patent protection. BioAffinity Technologies has recently secured a Japanese patent for its CyPath Lung diagnostic test, which employs flow cytometry to identify early-stage lung cancer. This development strengthens intellectual property protection and marks a notable milestone in expanding innovative, non-invasive cancer diagnostics in Japan. With rising lung cancer incidence and increasing demand for early detection solutions, the adoption of advanced cytology-based assays is expected to increase. Furthermore, Japan's focus on technological innovation and precision medicine is fueling market expansion, driving the integration of cutting-edge diagnostic solutions into routine clinical practice.

Latin America Histology And Cytology Market Trends

The Latin American histology and cytology industry is experiencing a steady surge, with Brazil emerging as a key player in the market. This upward trend can be attributed to a combination of factors, including the increasing need for early cancer detection, heightened government investments in healthcare, and the integration of cutting-edge diagnostic technologies. Furthermore, strategic partnerships are transforming the region's cytology services and infrastructure, while the rising incidence of cervical and other cancers is driving demand for advanced testing methods such as Pap tests, liquid-based cytology, and molecular diagnostics, ultimately propelling market growth in the area.

The Brazilian histology and cytology industry is witnessing a significant surge in the expansion of cytology services, primarily facilitated by strategic partnerships that drive diagnostic capabilities. In September 2024, Ikonisys formed an enhanced collaboration with BIO BRASIL BIOTECNOLOGIA to bolster their offerings in Sao Paulo, investing in 10 additional Cytofast Plus systems and 50,000 reagent kits. This move is designed to cater to the growing demand for Pap tests and urinary cytology diagnostics, thereby strengthening Brazil's diagnostic infrastructure. The acquisition of these cutting-edge solutions enables faster and more accurate detection of cervical and urinary tract cancers. Furthermore, the pilot implementation of fluorescence in situ hybridization (FISH) technology for enhanced Pap test capabilities marks a significant milestone in cytological screening, propelling market growth. With support from public healthcare initiatives and increasing adoption of advanced cytology solutions, Brazil's histology and cytology industry is poised to experience rapid expansion, ultimately improving early cancer detection and patient outcomes across the region.

Middle East & Africa Histology and Cytology Market Trends

The histology and cytology industry in the Middle East and Africa is thriving, fueled by the region's burgeoning capacity for locally producing sophisticated pathology equipment. In January 2024, Iran made a notable breakthrough with the development of a domestically crafted cryostat device, a vital tool for swiftly freezing and precisely cutting human tissue samples to facilitate rapid diagnosis of lesions. This innovative achievement not only accelerates early disease detection but also underscores the importance of immunofluorescence and enzyme immunochemistry studies, which are fundamental to pathology and cytology applications alike. By fostering local manufacturing of high-quality medical devices, the region is bolstering its healthcare infrastructure, reducing reliance on imports, and enhancing affordability and accessibility. As the focus on technological self-sufficiency intensifies and diagnostic tools continue to evolve, the demand for histology and cytology solutions in the Middle East and Africa is likely to surge, driving market growth.

The histology and cytology landscape in Saudi Arabia is being revolutionized by the rapid adoption of digital pathology and AI-driven diagnostic solutions, as exemplified by the 13th World Digital Pathology & AI Congress held in Abu Dhabi. In line with Vision 2030's ambitious healthcare infrastructure development and digital transformation agenda, the integration of cutting-edge technologies such as artificial intelligence, machine learning, and computational pathology is significantly enhancing diagnostic precision and speed. The country's substantial investments in innovative smart healthcare solutions and its unwavering commitment to revamping pathology services are pivotal drivers propelling market growth in the region.

Key Histology And Cytology Company Insights

Key market players in this industry include Hologic, Inc., Abbott, Becton, Dickinson, and Company, and a few others. To enhance their presence, these companies are employing diverse strategic tactics. This includes the creation of new products, collaborative ventures, and partnerships that foster growth and expansion.

Key Histology And Cytology Companies:

The following are the leading companies in the histology and cytology market. These companies collectively hold the largest market share and dictate industry trends.

- Hologic, Inc.

- Abbott

- Becton, Dickinson and Company

- F. Hoffmann-La Roche Ltd

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Danaher

- Sysmex Corporation

- Trivitron Healthcare

- Koninklijke Philips N.V.

Histology And Cytology Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 24.27 billion |

|

Revenue Forecast in 2030 |

USD 49.48 billion |

|

Growth rate |

CAGR of 15.31% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in (USD million) and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type of examination, product, application, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Hologic, Inc., Abbott, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd, Merck KGaA , Thermo Fisher Scientific, Inc. , Danaher, Sysmex Corporation, Trivitron Healthcare, Koninklijke Philips N.V. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Histology And Cytology Market Report Segmentation

This comprehensive forecast examines revenue growth and analyzes emerging trends across key segments between 2018 and 2030. The report segments the global histology and cytology market into distinct categories - examination type, product offerings, application areas, and geographic regions, providing a nuanced understanding of the industry's evolution over time.

-

Type of Examination Outlook (Revenue, USD Million, 2018 - 2030)

-

Histology

-

By Technique

-

Microscopy

-

Immunohistochemistry

-

Molecular pathology

-

Cryostat & Microtomy

-

-

-

Cytology

-

By Technique

-

Microscopy

-

Immunohistochemistry

-

Molecular pathology

-

Cryostat & Microtomy

-

-

By Application

-

Breast Cancer

-

Cervical Cancer

-

Bladder Cancer

-

Lung Cancer

-

Other Cancers

-

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments and Analysis Software System

-

Consumable and Reagents

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & Designing

-

Clinical Diagnostics

-

Point-of-Care (PoC)

-

Non-PoC

-

-

Research

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Comments

0 comment